Payday Loans in California: Top Lenders, Laws & Legality

Last Updated: January 17, 2026

| Lender | Expert Rating | Amount $ | Fee | Amount to return | Days of loan | Credit check | Learn More |

|---|---|---|---|---|---|---|---|

| $200 | $35.28 | $235.28 | 14-31 days | No check | SEE LOAN OPTIONSBy ACE with onlineLoans.org | ||

| $255 | $45 | $300 | 14-31 days | No check | SEE LOAN OPTIONSBy Speedy with onlineLoans.org | ||

| $200 | $35.29 | $235.29 | 14-31 days | No check | SEE LOAN OPTIONSBy Moneytree with onlineLoans.org | ||

| $255 | $45 | $300 | 14-31 days | No check | SEE LOAN OPTIONSBy Check City with onlineLoans.org | ||

| $255 | $45 | $300 | 14-31 days | No check | SEE LOAN OPTIONSBy Advance with onlineLoans.org | ||

| $255 | $45 | $300 | 14-31 days | No check | SEE LOAN OPTIONSBy Check&Go with onlineLoans.org |

(All lenders above are licensed by California DFPI. "Same-day" funding typically requires approval before a cut-off time on a business day; otherwise funding is next business day. Fees shown are the state-allowed maximum; some lenders may charge lower fees.)

Understanding Payday Loans in California

What is a payday loan? It's a short-term loan (in California, for $300 or less including fees) that you typically repay in full on your next payday dfpi.ca.gov dfpi.ca.gov. You either write the lender a post-dated check or authorize an electronic debit for the loan amount plus fees. On your next payday (or within a maximum of 31 days), the lender cashes the check or debits your account to collect payment.

Why do people use payday loans? They're easy to get and fast. Lenders generally do not require good credit – approval is based on having a steady income and a bank account. Applications are often done online in minutes with near-instant decisions. If approved, you can get cash the same day or by the next business day, which is helpful for urgent expenses like car repairs or medical bills. However, this convenience comes at a steep price: payday loans carry extremely high fees and annual interest rates, so borrowers should be cautious.

Are Payday Loans Legal in California?

Yes. California permits payday lending, but with strict state laws to protect consumers dfpi.ca.gov. Both storefront and online payday loans are legal only if the lender is licensed by the California Department of Financial Protection and Innovation (DFPI). Always verify a lender's California license before borrowing – unlicensed online lenders may be operating illegally dfpi.ca.gov.

Key California payday loan laws and regulations: (updated as of 2025)

- Maximum loan amount: The check you give the lender (loan principal + fee) cannot exceed $300. In practice, this means you can borrow up to $255 in cash, with a $45 fee, for a total of $300 due dfpi.ca.gov.

- Fees and APR: Lenders can charge a fee up to 15% of the check's face value. This equals about $17.65 per $100 borrowed k6agency.com. For example, a $255 loan will cost $45 in fees (you repay $300). That fee equates to an APR of ~460% for a typical 14-day loan cashloansdirect.com. (California does not cap the APR explicitly – the 15% fee is the cap, which results in triple-digit APRs.)

- Loan term: The loan is due on your next payday, but no later than 31 days from the loan date acecashexpress.com. There are no extensions beyond 31 days.

- One loan at a time: You cannot have more than one payday loan open in California simultaneously acecashexpress.com.

- No rollovers: Lenders cannot refinance or "roll over" a payday loan by issuing a new loan to pay off the old one dfpi.ca.gov. Each loan must be paid off in full before another is taken.

- No additional charges for payment plans: If you can't repay on time, a lender may (at its discretion) allow an extended payment plan, but no extra fees or interest can be charged for that extension dfpi.ca.gov. (Lenders are also barred from adding late fees or more interest when you defer payment cashloansdirect.com.)

- NSF fee limit: If your check or debit for the loan bounces, the lender can charge at most a one-time $15 NSF fee cashloansdirect.com. They cannot sue or threaten criminal action for bounced checks – California treats it as a civil debt matter.

- Licensed lenders: All payday lenders (including online companies) must be licensed by the DFPI cashloansdirect.com. You can use the DFPI's online database to verify a lender's license and check for any disciplinary actions dfpi.ca.gov. It's risky to borrow from unlicensed websites, as they may violate state rate limits or consumer protection laws.

Bottom line: Payday loans are legal in California within these limits, but they remain an expensive form of credit. The DFPI and consumer advocates warn that frequent use can lead to a debt cycle where borrowers pay more in fees than the original loan amount dfpi.ca.gov dfpi.ca.gov. Always consider alternatives and borrow responsibly.

Lender Reviews

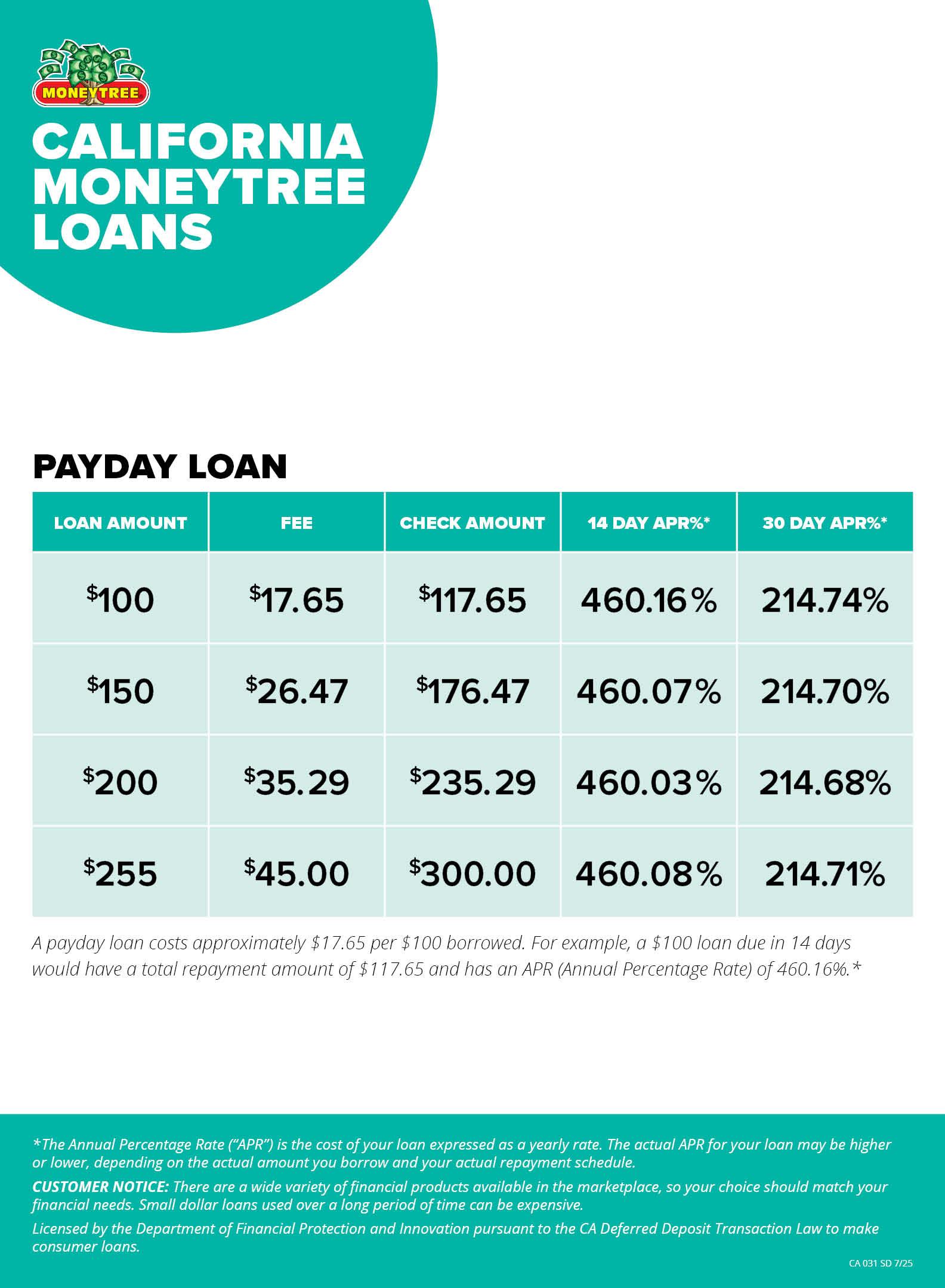

ACE Cash Express Review

ACE Cash Express is another major payday lender serving California, known for its wide range of financial services and quick funding options. ACE has been in business for decades (since 1968) trustpilot.com and operates both online and through numerous CA storefronts.

Loan amounts & terms:

$100 to $255 per loan in California, due by your next payday (no later than 31 days) acecashexpress.com acecashexpress.com. The exact amount you can borrow depends on your income and underwriting (first-time customers might be approved for a lower amount).

Fees:

ACE charges up to the legal limit: 15% of the total loan amount. For example, borrowing $200 will cost $30 in fee, and $255 will cost $45 in fee. This equates to very high APRs (~400%+), as is standard for payday loans in California cashloansdirect.com. ACE does not charge a fee to apply, and if you change your mind, they offer a 72-hour satisfaction guarantee – you can return the loan principal within 72 hours and cancel the loan with no charges acecashexpress.com.

Image source: https://www.acecashexpress.com/uploads/files/products/payday/internet/rates/CA_FeeSchedule.pdf

Eligibility requirements:

You need to be 18 or older with valid government ID and Social Security number (or ITIN). A checking account (open and active) and proof of income (like a pay stub or benefits statement) are required. ACE will perform some credit and financial history check (often using alternative credit bureaus), but poor credit is not a barrier – "anyone can apply" and they focus on your ability to repay rather than FICO scores acecashexpress.com.

Application process:

Online or in-store. Online, you fill out a secure application on ACE's website. It's quick – many customers get an instant approval decision. If approved, you e-sign the loan agreement. ACE gives you multiple ways to get your cash: you can have it loaded to your debit card instantly, deposited to your bank account by the next business day, or pick up cash the same day at an ACE store acecashexpress.com. (You'll choose your preference during the application.)

Speed of funding:

Excellent. If you're approved online, ACE offers instant funding to a qualifying debit card (often within 30 minutes) acecashexpress.com. Alternatively, they can do a same-day cash pickup in one of their 100+ California stores acecashexpress.com acecashexpress.com. Standard ACH deposit to your bank is usually next business day (if you complete the application by their daily cutoff) acecashexpress.com. In short, you can often get your money within hours with ACE.

Reputation & customer feedback:

ACE Cash Express is a large, trusted name in payday lending. They are fully licensed and a member of industry trade associations. Customer reviews indicate a high level of satisfaction with the speed and convenience: on Trustpilot ACE is rated around 4.7 out of 5 stars (categorized as Excellent) based on over 10,000 reviews trustpilot.com. Many Californians also use ACE's other services (like check cashing and money orders) and appreciate the one-stop shop. However, like all payday lenders, ACE has some complaints about costs – and indeed their loans are costly if not paid as agreed. Bottom line: ACE stands out for its instant funding options and long-standing presence. It's a strong option if you need cash urgently and want the ability to walk into a store for service or use a well-optimized online system.

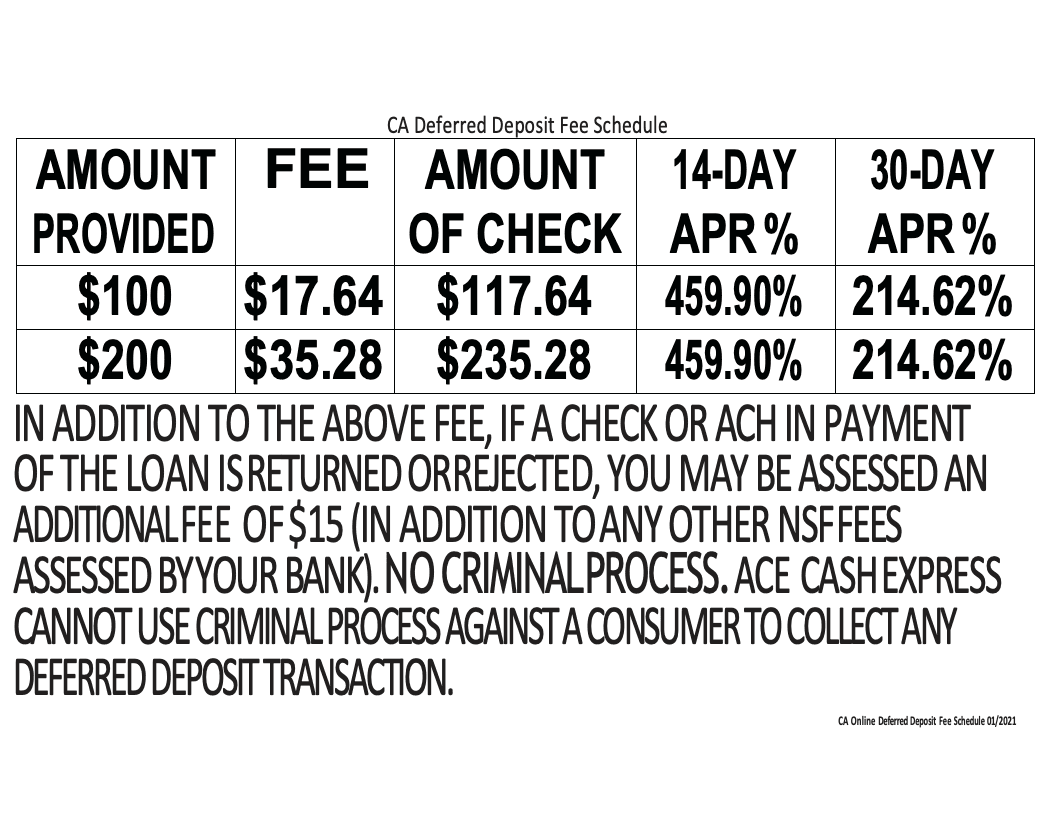

Speedy Cash Review

Speedy Cash is a well-known payday loan lender with an extensive online presence and several store locations in California. True to its name, Speedy Cash focuses on getting cash to borrowers quickly – often with options for instant funding. They also offer other products (installment loans, lines of credit) in some states, but in California their offerings include the traditional payday loan.

Loan amounts & terms:

$100 to $255 for payday loans in California speedycash.com. The state cap applies, so first-time borrowers may be limited to a lower amount until they build a history. The loan term ranges from as short as 7 days up to 31 days, but most commonly it's aligned with your pay cycle (around 14 days for bi-weekly pay). Payment is due in full on that date.

Fees:

Speedy Cash charges the California-allowed fee of up to 15%. That means if you borrow $255, you owe $300 on payday (the $45 fee is 15% of $300). This is equivalent to very high APRs (hundreds of percent), typical of payday loans. They do not charge additional origination fees or monthly fees – just the one-time finance charge. Speedy Cash is transparent about the cost before you finalize the loan. (For perspective, one Speedy Cash customer on WalletHub noted the ~300%+ interest as "outrageous" wallethub.com – so only use these loans for short-term emergencies.)

Image source: https://www.speedycash.com/rates-and-terms/california/

Eligibility requirements:

You must meet the standard criteria: 18+ years old, valid ID, Social Security Number, proof of income, and an active checking account. Speedy Cash is known for being lenient with credit – they state that borrowers with any credit history can be approved as long as you have the ability to repay 1firstcashadvance.org. They may use alternative credit agencies to review your history, but there is no hard credit score cutoff. You cannot be in bankruptcy or have an outstanding Speedy Cash loan.

Application process:

Online: Speedy Cash has a user-friendly online application on their website or mobile app. It literally takes a few minutes to fill out. You can also apply by phone or in person at a Speedy Cash store. Approval is very fast – often within seconds or minutes of submission, you'll get a decision. Once approved, you review the loan terms and sign electronically. Speedy Cash stands out for its funding options: you can choose to receive money in as little as 10 minutes on a debit card or via an ACH transfer to your bank 1firstcashadvance.org. If you opt for the debit card funding, you'll provide your debit card info – eligible Visa or Mastercard debit cards can be loaded almost immediately (typically within 30 minutes). ACH direct deposit usually arrives the same day or next business day depending on when you applied. If you applied in a store, you walk out with cash in hand.

Speed of funding:

One of the fastest. Speedy Cash is among the few lenders offering instant funding – customers who choose the debit card option often get funds within minutes after approval 1firstcashadvance.org. For example, if you're approved at noon, you might have money on your debit card by 12:30 PM. ACH deposits, if approved early, can hit your bank account by that evening or the next morning. And of course, in-store loans give immediate cash. This speed is a major selling point for Speedy Cash.

Reputation & customer reviews:

Speedy Cash has a mixed but generally positive reputation. On Trustpilot, they hold about a 4.4/5 star rating with over 10,000 reviews trustpilot.com, and ConsumerAffairs also shows ~4.5/5, indicating many users appreciate the fast and easy service. Customers frequently praise the quick approvals and that Speedy Cash will work with those who have bad credit. On the flip side, the company has a poor rating on the BBB and some other platforms (e.g., WalletHub ~1.6/5) wallethub.com 1firstcashadvance.org. Complaints include the high cost (which is inherent to payday loans) and some customer service issues or aggressive collections. It's worth noting that in 2018 Speedy Cash faced a class-action lawsuit alleging certain unlawful practices 1firstcashadvance.org, but they continue to operate legitimately under state licenses. In summary, Speedy Cash is a legit and extremely fast option for payday loans – just remember to repay on time to avoid any troubles, as the costs will quickly add up if the loan is extended.

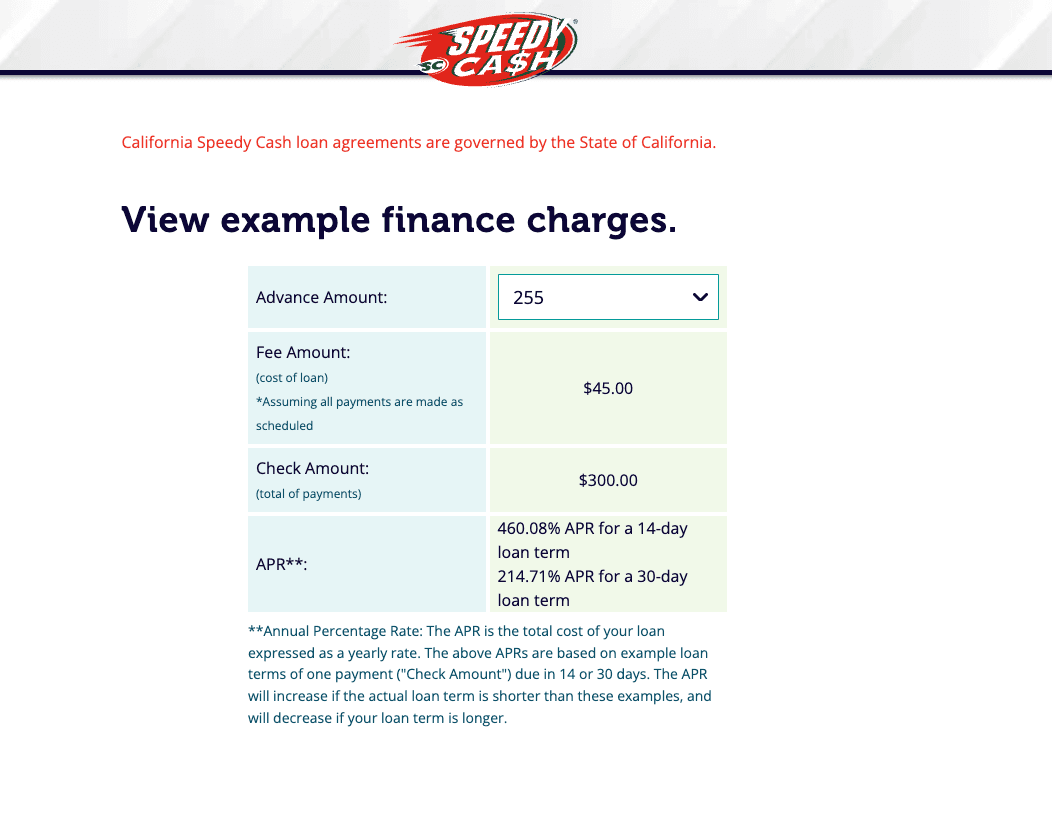

Moneytree Review

Moneytree is a regional payday lender that started in California and serves the West Coast. Founded in 1983, Moneytree operates multiple branch locations in California (as well as an online lending platform). They pride themselves on professional, friendly service – and many Californians are familiar with their retail locations. Moneytree offers payday loans with a transparent fee structure and a few unique features like high loan limits for repeat customers and instant funding options.

Loan amounts & terms:

Up to $255 for a payday loan in California moneytreeinc.com. (Moneytree actually mentions loans "up to $255¹ with approval" – $255 being the cash disbursed, plus the fee makes $300 total moneytreeinc.com.) First-time borrowers might not get the full $255; it depends on your income and their underwriting. The loan term is generally until your next payday, from a few days up to 31 days maximum. By law it cannot exceed 31 days. Moneytree also offers larger installment loans in California under a different license, but those are separate from the payday loan product.

Fees:

Moneytree charges approximately $17.65 per $100 borrowed on a 14-day payday loan k6agency.com. This is effectively the same as the 15% of face amount cap – for example, a $100 loan due in 14 days would cost $17.65 in fee, and you'd repay $117.65 k6agency.com. Borrowing the maximum $255 costs $45 in fee (repay $300). They provide a fee schedule on their website so you know the exact dollar cost for any given loan amount. Importantly, if you cannot pay on time, Moneytree does not charge any additional interest or fees beyond that initial $45 max – you would just owe the $300 until it's paid (and possibly an NSF fee if your payment fails). Moneytree's fee is comparable to other lenders – extremely expensive in APR terms, but tightly regulated.

Eligibility requirements:

Standard requirements apply: 18 or older, government-issued ID, Social Security Number (or ITIN/Alien registration), and a verifiable source of income. You'll need to provide a proof of income (recent pay stub, etc.) and a working phone number and address. A checking account is usually required for payday loans (if applying online, definitely yes; in branch they may allow you to walk out with cash but you still need to provide a check or ACH authorization for repayment). Moneytree may approve loans with no traditional credit check – they state that they might check credit bureaus in some cases, but many borrowers are approved based on income and account status alone 1firstcashadvance.org 1firstcashadvance.org. They are licensed and follow California's rule of one loan at a time.

Application process:

In-Branch: You can walk into any Moneytree branch (they have dozens in CA) and apply with ID, proof of income, and a check. You'll typically receive cash on the spot if approved, and the whole process can take 15–20 minutes for new customers. Online: Moneytree's website allows California residents to apply online. The online application will verify your identity and income details (you may need to upload documents). Decisions are often quick – sometimes instant, other times a few minutes if manual review is needed. Once approved, you choose how to get the funds. Moneytree offers instant funding to your debit card in about 30–45 minutes, which is very fast 1firstcashadvance.org. Alternatively, they can do an ACH bank deposit – but note this method is slower with Moneytree than some others, potentially taking 1 to 5 business days for the funds to appear depending on your bank 1firstcashadvance.org 1firstcashadvance.org. (The delay likely accounts for possible bank holds; often it will be 1-2 days in practice.) Lastly, you have the option to pick up cash at a Moneytree branch the same day – you could apply online and then go to a branch to get the cash immediately.

Speed of funding:

Same-day options available. If speed is critical, Moneytree's fastest method is to apply online and request Instant Funding to a debit card – you might have the money in under an hour 1firstcashadvance.org. Or apply online and then visit a branch for immediate cash (during business hours). If you choose a normal bank deposit, be prepared that it might not be as instant; to be safe, expect maybe the next business day or two for ACH (they cite up to 5 days, but that's usually the worst-case scenario). Moneytree is unique in that they have both a robust online system and physical locations, giving borrowers flexibility in how to receive funds.

Reputation & customer experience:

Moneytree has a long history in California, often marketing themselves as a more personal, higher-quality service in the payday loan industry. They have earned customer loyalty at their branches for friendly service – many Yelp reviews praise individual tellers and the professional atmosphere (for example, offering free coffee at branches, etc.). Customer ratings: Moneytree's online presence shows a bit of a mixed picture. The company's Trustpilot profile is not very active (only a handful of reviews). On Yelp, however, Moneytree's average rating is ~3.8 out of 5 across many reviews 1firstcashadvance.org. Many locations have 4 or 5 stars, while a few have lower scores – this suggests the experience can vary by branch. Common compliments are about courteous staff and quick help, while complaints sometimes cite billing/payment confusion or high costs. The BBB rates Moneytree A- (with some customer complaints noted) 1firstcashadvance.org 1firstcashadvance.org. It's worth noting Moneytree was fined by the CFPB in 2016 for some debt collection practices 1firstcashadvance.org, but they've since adjusted policies. As a licensed lender with decades in business, Moneytree is generally considered reliable and treats customers fairly, but do remember that the high cost and potential risks (as with any payday loan) are present. If you use Moneytree, take advantage of their clarity – know exactly what you must repay and have a plan to pay off the loan to avoid any long-term issues.

Check City Review

Check City is a direct payday lender that operates online in California (and has physical stores in a few other states like Nevada and Utah). In California, Check City is online-only, but it is a fully licensed lender in the state checkcity.com. They are known for a fast application process and good customer service, and they tout an "Excellent" Trustpilot rating from their customers.

Loan amounts & terms:

Maximum $255 cash per loan in California (which results in a $300 check including the fee). The loan term will be until your next payday (up to 31 days). Check City allows you to borrow any amount up to the max, in increments (for example, you could borrow just $100 or $200, not necessarily the full $255, depending on your need and approval). As with others, you'll owe the full amount plus fee on your due date.

Fees:

Check City charges the standard 15% fee of the check amount. Borrow $255 and you'll pay $45 in fees. Their site is transparent about rates – for California, they clearly state the cost per $100 and give examples. That works out to the same ~460% APR for a 2-week loan as other lenders. There are no additional fees beyond this finance charge (no application fee, no prepayment fee – you can repay early to save interest, though on a short loan the fee is typically fixed).

Eligibility requirements:

You must be 18+ and a resident of California with valid identification. A steady income is required (employment or other income sources) and an active checking account that accepts ACH transfers. You'll need to provide your routing and account number and authorize Check City to debit it for repayment. No credit score requirements – Check City, like most payday lenders, focuses on current income and checking account status rather than credit history. They claim to be a direct lender and licensed in CA, which means you deal directly with them (not a third-party lead generator) checkcity.com. They also adhere to the one-loan-at-a-time rule.

Application process:

Fully online: You can apply on Check City's website 24/7. The form will ask for personal details, income info, and bank details. Many applications get an automatic decision. If approved, you then select how you want the funds. Funding options: Check City offers same-day ACH deposit to your bank account (if you're approved and finalize by a certain cut-off, you can get the funds that same business day). They also have an Instant Funding option to load the money onto your debit card – however, instant funding is available only for returning customers at this time checkcity.com. (Returning customers are those who have paid off a previous loan with Check City; they get the perk of truly instant debit card deposits.) For new customers, you'll likely receive a fast ACH deposit. In either case, funding is quick. There are no physical California Check City stores to visit, so all is done online and funds are delivered electronically.

Speed of funding:

Very fast. Check City advertises that qualified customers can get same-day or even instant funding. For many borrowers, the money is deposited the same business day (if the loan is approved by early afternoon). The instant debit card funding (for repeat borrowers) means you could have cash within minutes after approval. If your loan is approved after hours, the deposit would be on the next business morning. Overall, Check City's funding speed is on par with other top lenders – they understand that when you need a payday loan, you often need it quickly.

Reputation & customer reviews:

Check City receives high marks from customers for its service. They highlight their great customer service and ease of use on their site, and this is backed up by external reviews. Check City has an Excellent Trustpilot rating around 4.9/5 stars with over 2,500 reviews trustpilot.com – customers frequently mention the reliability, simplicity of the process, and the company's transparency. Since Check City is a direct lender, people like that they're dealing with one company from start to finish. The company has been around since the 1980s and has built a positive reputation in the states it operates. In California, even though you can't walk into a local Check City store, you can expect the same level of service through their online platform. As with all these lenders, keep in mind the high cost – but if a payday loan is your choice, Check City is a highly rated option to consider.

Advance America Review

Advance America is one of the nation's largest payday loan companies and is licensed in California. They have 100+ store locations in California (for those who prefer in-person service) and an easy online application.

Loan amounts & terms:

Up to $255 per California law (you'll repay up to $300 including the fee). Loans are due on your next payday (usually 14 days, but up to 31 days) acecashexpress.com.

Fees:

Charges the maximum 15% fee allowed. That's $45 on a $300 loan (e.g. borrow $255, pay back $300). This equals ~460% APR for a 2-week loan cashloansdirect.com. No other fees (no application or prepayment fees).

Eligibility requirements:

Must be 18+, a California resident, with a valid ID, active checking account, and proof of steady income (e.g. pay stub or benefits award). No minimum credit score – bad credit is okay. (They will verify some personal and financial information, but do not perform a traditional hard credit check for payday loans.)

Application process:

Can apply online in minutes or at a local branch. The online form asks for personal info, employment/income details, and bank account for depositing funds. It's straightforward and no collateral is required.

Speed of funding:

Fast funding is a hallmark. If you apply and get approved early in the day, Advance America can deposit funds the same day (typically by end of day) 1firstcashadvance.org. Approvals after the morning cutoff are funded the next business day. Customers can also opt to pick up cash immediately at a branch.

Reputation & customer reviews:

Advance America is a well-established lender (operating since 1997). It has an Excellent reputation among many users – boasting a 4.9/5 star rating on Trustpilot from over 120,000 reviews trustpilot.com. Borrowers frequently praise the quick and easy process and the helpful customer service. (Of course, some reviews mention the high cost – borrowers should be prepared to pay the fees on time to avoid issues.) Overall, as a licensed and long-running company, Advance America is a top-rated choice for payday loans in CA in terms of reliability and speed.

Check 'n Go Review

Check 'n Go is a national payday loan and installment loan company that operates online in California (and has some partner store locations under the Allied Cash Advance name). They've been helping customers with short-term loans for over 20 years. In California, Check 'n Go offers online payday loans with straightforward terms.

Loan amounts & terms:

Up to $255 for California borrowers. The loan term is typically until your next paycheck (anywhere from about 2 to 4 weeks, but not beyond 31 days). You'll generally write a check or set up an ACH for the loan amount plus fee, dated to your payday.

Fees:

Check 'n Go charges the standard California fee: 15% of the face amount of the loan. For instance, borrowing $255 will incur a $45 fee. There are no hidden fees. If you cannot repay on time, by law they cannot charge extra interest for extending the time (though they may not offer an extension by default) dfpi.ca.gov. The cost is high (roughly 460% APR for a 2-week loan), so make sure you understand the fee before proceeding.

Eligibility requirements:

Basic requirements include being at least 18, a resident of California, with a valid ID and Social Security number. You need an active checking account in your name and proof of income (such as recent pay stubs or benefit statements). Check 'n Go does not require good credit – they will verify some information but have no minimum credit score. In fact, they consider various income sources (employment, unemployment benefits, Social Security, etc.) as eligible income lendedu.com lendedu.com. You cannot have an outstanding payday loan elsewhere in California when applying.

Application process:

Online: You can complete the entire process on Check 'n Go's website. The application will ask for personal info, income details, and bank account info for funding/repayment. It's a quick process with an almost instant decision in many cases. If approved, you sign the loan agreement electronically. In-store: While Check 'n Go's own branded stores are limited in California, they partner with Allied Cash Advance centers in some cities. In-store applications can yield cash in hand immediately. Online approvals are typically funded by the next business day (via direct deposit to your bank) lendedu.com. Note: You cannot pick up an online-approved loan in a store; online loans are funded via bank deposit.

Speed of funding:

Fast: If you apply online and are approved, Check 'n Go usually deposits the money by the following business day into your account lendedu.com. Some customers applying early in the day have reported same-day deposits, but generally expect next-day. If you go to a physical location (Allied Cash Advance), you can get cash on the spot during the visit. Either way, funding is quick – much quicker than a traditional bank loan.

Reputation & reviews:

Check 'n Go has a strong online reputation for customer service and ease of use. Trustpilot shows a 4.5/5 star rating based on nearly 10,000 customer reviews lendedu.com, indicating most users find the service reliable and convenient. Customers often mention the simple application and helpful staff. The company is also rated A+ by the BBB (though not accredited), reflecting that they respond to complaints. Some negative feedback exists, mainly about the high cost (which is inherent to payday loans) and aggressive collections if a loan goes unpaid. Overall, Check 'n Go is viewed as a credible and customer-friendly lender, making it a solid choice for a quick online payday loan in California.

Conclusion: Making an Informed Decision

Payday loans in California can be a quick fix for urgent cash needs, but they come with significant costs and risks. It's encouraging that California law provides protections – capping the loan size and fees, and prohibiting rollovers – yet the fees are still substantial (about $45 on a $255 loan cashloansdirect.com). Before taking a payday loan, it's wise to explore alternatives if possible: for example, asking for an extension from creditors, borrowing from friends/family, or looking into installment loans or credit union loans which might have lower interest.

The lenders reviewed above are among the best in the payday loan business – they are licensed, transparent, and fast – but even so, the DFPI warns that payday loans can "pull you into a cycle of debt" if used repeatedly dfpi.ca.gov. If you do choose to borrow a payday loan online in California, use the information in this guide to compare lenders and select a reputable one that suits your needs (consider things like how fast you need the money, and any special features like ACE's 72-hour cancellation or Speedy Cash's 24/7 instant funding). Borrow only what you truly need and have a plan to pay it off on time. All these lenders will electronically withdraw the payment on the due date, so ensure the funds are in your account to avoid overdrafts and additional fees.

Finally, remember to check the lender's license and read the loan agreement carefully before signing. When used responsibly and infrequently, a payday loan can be a useful financial tool for addressing short-term emergencies. But always go in with full awareness of the costs and your obligations. By being informed – about California's laws, your rights, and the lender's terms – you can better protect yourself even when borrowing under the pressure of an emergency. Good luck, and borrow safely!

Sources

California Department of Financial Protection & Innovation – "Payday Loans & Cash Advances: What Consumers Need to Know" (California payday loan legality and limits) dfpi.ca.gov dfpi.ca.gov.

Cash Loans Direct – "Beginner's Guide to Applying for Payday Loans in California" (State law details on loan caps, fees, APR) cashloansdirect.com cashloansdirect.com.

ACE Cash Express – California Payday Loan FAQs (example of loan terms, 31-day limit, one-at-a-time rule) acecashexpress.com acecashexpress.com.

Trustpilot – Customer Ratings (Advance America 4.9★/5 trustpilot.com, ACE Cash Express 4.7★ trustpilot.com, Check 'n Go 4.5★ lendedu.com, Speedy Cash 4.4★ trustpilot.com, Moneytree Yelp ~3.8★ 1firstcashadvance.org, Check City 4.9★ trustpilot.com).

1F Cash Advance – Lender Reviews (Funding speeds: Speedy Cash instant funding 1firstcashadvance.org, Moneytree instant and ACH funding times 1firstcashadvance.org 1firstcashadvance.org; Moneytree company background and reputation) 1firstcashadvance.org 1firstcashadvance.org.

LendEDU – "Check 'n Go Review 2025" (Customer feedback: Trustpilot rating 4.5★, BBB info) lendedu.com lendedu.com.